Russia-Ukraine Conflict: Impact on Logistics and Textiles-Apparel Industry

The tensions between Russia and Ukraine continue to place the world order into greater uncertainty. Global economic recovery is expected to slow down after consistently picking up pace in 2021. Most notable economic impact is being felt through the commodity as well as logistics sectors, where costs have shot up rapidly. A dramatic rise in prices of major fuel products and food staples is likely to impact growth prospects of major economies. These are expected to add to already high inflation levels in the European economies particularly, which are more dependent on supplies from Russia and Ukraine.

While oil prices and supply have continued to be a concern for many economies, China and India have secured supplies of Russian oil at discounted prices. However, due to the sanctions, other countries have been on a search to find alternative sources of fuel. Latest condition from Russia that mandates countries to pay for its oil in rouble has put further pressure on the economies across the world which depend heavily on its energy exports.

Impact on freight – ocean, air, and rail

On the trade front, flows through sea have remained largely unimpacted due to the war. The largest impact on ocean freight from the war perhaps has come from disruptions to flows to and from Russia. Maersk and other major shipping companies have stopped taking orders to and from Russia, which may perhaps disrupt overall global trade to a certain extent. Even then, shipping rates from Asia to Europe/US have remained relatively stable and have fallen recently; however, they are still much higher than last year. Derry’s World Container Index shows a decline in overall prices to $8,470 per 40-ft container as on March 24, 2022. This is 10.6 per cent lower than container prices last month, almost a 10 per cent drop from mid of January 2022 and more than an 18 per cent drop from the peak achieved in September 2021. All routes that would have supposedly been disrupted due to the Russia-Ukraine war are seeing easing of rates. Rates on China-Europe and China-US routes were down by almost 2-8 per cent between March 17, 2022, and March 24, 2022.1

In one of its recent research notes (March 22, 2022), Freightos, an online marketplace for shipping industry, also indicates these trends in the shipping industry. Despite surging coronavirus cases in major port cities in China, port operations have not been disrupted as severely as Yantian last year. But export volumes in China were also lower for the month of February 2022 which largely reflects the ease in shipping rates. However, the note mentions that the easing in rates is perhaps temporary, and they are expected to rise due to increasing volumes.

In the latest Global Port Tracker published by National Retail Federation and Hackett Associates in the US, it is suggested that import demand in the US continues to be strong and will likely remain so due to stronger economic recovery there.2 Corroborating facts from Freightos, the note mentions imports from Asia to be lower m/m in February 2022 but relative to last year, imports were almost 11 per cent higher. The estimates for the next few months point towards much greater demand facing the logistics sector and therefore increased congestion at the ports. Contrary to the expectation, the current conflict between Russia and Ukraine has perhaps eased some pressure on ocean freight, leading to more blank sailings to Europe. Inflationary pressures are also contributing tremendously to the current demand slowdown and the easing of pressures on ocean freight rates.

Air freight rates on the other hand are climbing up despite the fact that demand has softened more recently. DHL in its most recent update on Air Freight sector mentions that 17 per cent of global trade through air has been impacted due to the Russia-Ukraine conflict. The conflict, through closing of airspaces and heightened uncertainty of demand, has impacted manufacturing and cargo movement across different trade routes. Closing of the Russia-Ukraine airspace has led to lengthy transit times on major routes, constraining capacity further. In addition to this, there are labour issues at major airports in Europe and Asia-Pacific leading to disruption in warehouse activities and further delays in transit times.

Rail freight has also been impacted heavily from the conflict, resulting in much of the freight flows shifting to ocean. The most important rail link connecting China to Europe goes through parts of Russia and Ukraine and has seen disruptions due to the current conflict. The China-Europe rail link carried goods worth $75 billion last year and was a significant alternative to ocean trade in 2021, when port container shortages were at their peak. Much of the trade flows between China and Europe through rail is therefore suspended and has shifted to maritime. This has also impacted trade between Vietnam and Europe as the rail link between the two regions is also halted for the time being. Trade flows from Bangladesh which were being routed through China are also likely to get disrupted because of this.

Impact on textile and apparel industry from the conflict.

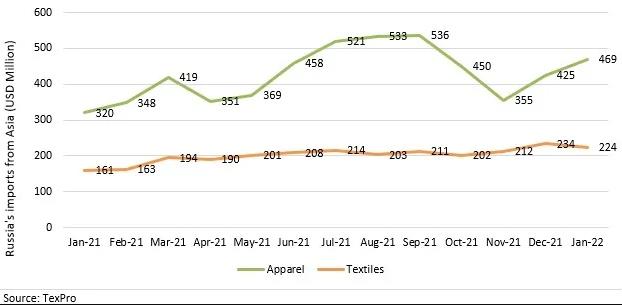

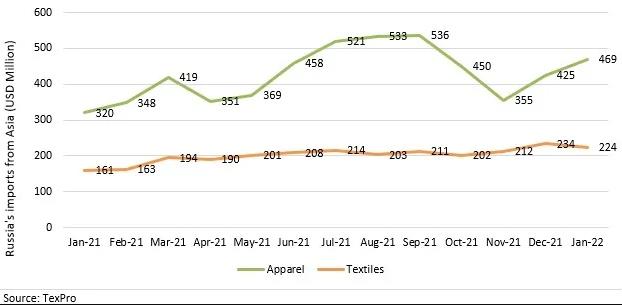

A major concern regarding trade flows with Russia and specially pertaining to Asian countries such as Bangladesh and Vietnam relates mostly to payment issues due to the sanctions. This could hurt Asian as well as India’s textile and apparel industry; however, the textile and apparel demand from Russia is not as significant. Russia imported $650-700 million of textile and apparel products every month from Asian countries (Figure 1), half of which constitutes only apparel imports. If Russian imports stop or shrink dramatically for some time due to the sanctions, it will cost the Asian countries close to $1-2 billion or more in export revenues depending on how long it continues. Country-wise, China is expected to see a much larger impact as its textile and apparel exports to Russia are the largest, which are close to $400 million every month. However, China’s internal supply challenges and surge in COVID-19 infections have also impacted its exports tremendously. Bangladesh is the second largest exporter to Russia, sending close to $90-100 million every month. India exports close to $18-20 million of textiles and apparel to Russia every month and will perhaps see a reduction in its exports revenues of this amount in the coming months.

Figure 1: Russia’s textile and apparel imports from Asia

One significant cause of concern for the global textile and apparel industry is the rising cost of essential raw materials such as crude oil and rising cost of food, which in turn raises the cost of labour. Several of the Asian economies are dependent heavily on coal and oil from Russia, and food supplies from Ukraine. UNCTAD update on the Russian-Ukraine crisis shows that Turkey, China, Egypt, and India are the countries that are most dependent on food supplies from Russia and Ukraine. These are incidentally also major textile and apparel suppliers globally. Inflation in Turkey has skyrocketed to almost 54.44 per cent in February 2022, which is expected to significantly impact sourcing from the country. Consumer prices inflation in Bangladesh has also risen rapidly to 6.17 per cent, predominantly due to increase in food prices.

On the other hand, textiles and clothing demand is expected to be impacted heavily as prices of textile-apparel and leather products are also expected to rise sharply. The UNCTAD note suggests a 10 per cent rise in consumer prices for textiles, apparel, and leather products due to a rise in container freight rates. The analysis is restricted only to impact from freight rates which hasn't happened yet. However, the actual impact may perhaps be higher when raw material and labour costs are factored into the consumer prices.

While oil prices and supply have continued to be a concern for many economies, China and India have secured supplies of Russian oil at discounted prices. However, due to the sanctions, other countries have been on a search to find alternative sources of fuel. Latest condition from Russia that mandates countries to pay for its oil in rouble has put further pressure on the economies across the world which depend heavily on its energy exports.

Impact on freight – ocean, air, and rail

On the trade front, flows through sea have remained largely unimpacted due to the war. The largest impact on ocean freight from the war perhaps has come from disruptions to flows to and from Russia. Maersk and other major shipping companies have stopped taking orders to and from Russia, which may perhaps disrupt overall global trade to a certain extent. Even then, shipping rates from Asia to Europe/US have remained relatively stable and have fallen recently; however, they are still much higher than last year. Derry’s World Container Index shows a decline in overall prices to $8,470 per 40-ft container as on March 24, 2022. This is 10.6 per cent lower than container prices last month, almost a 10 per cent drop from mid of January 2022 and more than an 18 per cent drop from the peak achieved in September 2021. All routes that would have supposedly been disrupted due to the Russia-Ukraine war are seeing easing of rates. Rates on China-Europe and China-US routes were down by almost 2-8 per cent between March 17, 2022, and March 24, 2022.1

In one of its recent research notes (March 22, 2022), Freightos, an online marketplace for shipping industry, also indicates these trends in the shipping industry. Despite surging coronavirus cases in major port cities in China, port operations have not been disrupted as severely as Yantian last year. But export volumes in China were also lower for the month of February 2022 which largely reflects the ease in shipping rates. However, the note mentions that the easing in rates is perhaps temporary, and they are expected to rise due to increasing volumes.

In the latest Global Port Tracker published by National Retail Federation and Hackett Associates in the US, it is suggested that import demand in the US continues to be strong and will likely remain so due to stronger economic recovery there.2 Corroborating facts from Freightos, the note mentions imports from Asia to be lower m/m in February 2022 but relative to last year, imports were almost 11 per cent higher. The estimates for the next few months point towards much greater demand facing the logistics sector and therefore increased congestion at the ports. Contrary to the expectation, the current conflict between Russia and Ukraine has perhaps eased some pressure on ocean freight, leading to more blank sailings to Europe. Inflationary pressures are also contributing tremendously to the current demand slowdown and the easing of pressures on ocean freight rates.

Air freight rates on the other hand are climbing up despite the fact that demand has softened more recently. DHL in its most recent update on Air Freight sector mentions that 17 per cent of global trade through air has been impacted due to the Russia-Ukraine conflict. The conflict, through closing of airspaces and heightened uncertainty of demand, has impacted manufacturing and cargo movement across different trade routes. Closing of the Russia-Ukraine airspace has led to lengthy transit times on major routes, constraining capacity further. In addition to this, there are labour issues at major airports in Europe and Asia-Pacific leading to disruption in warehouse activities and further delays in transit times.

Rail freight has also been impacted heavily from the conflict, resulting in much of the freight flows shifting to ocean. The most important rail link connecting China to Europe goes through parts of Russia and Ukraine and has seen disruptions due to the current conflict. The China-Europe rail link carried goods worth $75 billion last year and was a significant alternative to ocean trade in 2021, when port container shortages were at their peak. Much of the trade flows between China and Europe through rail is therefore suspended and has shifted to maritime. This has also impacted trade between Vietnam and Europe as the rail link between the two regions is also halted for the time being. Trade flows from Bangladesh which were being routed through China are also likely to get disrupted because of this.

Impact on textile and apparel industry from the conflict.

A major concern regarding trade flows with Russia and specially pertaining to Asian countries such as Bangladesh and Vietnam relates mostly to payment issues due to the sanctions. This could hurt Asian as well as India’s textile and apparel industry; however, the textile and apparel demand from Russia is not as significant. Russia imported $650-700 million of textile and apparel products every month from Asian countries (Figure 1), half of which constitutes only apparel imports. If Russian imports stop or shrink dramatically for some time due to the sanctions, it will cost the Asian countries close to $1-2 billion or more in export revenues depending on how long it continues. Country-wise, China is expected to see a much larger impact as its textile and apparel exports to Russia are the largest, which are close to $400 million every month. However, China’s internal supply challenges and surge in COVID-19 infections have also impacted its exports tremendously. Bangladesh is the second largest exporter to Russia, sending close to $90-100 million every month. India exports close to $18-20 million of textiles and apparel to Russia every month and will perhaps see a reduction in its exports revenues of this amount in the coming months.

Figure 1: Russia’s textile and apparel imports from Asia

One significant cause of concern for the global textile and apparel industry is the rising cost of essential raw materials such as crude oil and rising cost of food, which in turn raises the cost of labour. Several of the Asian economies are dependent heavily on coal and oil from Russia, and food supplies from Ukraine. UNCTAD update on the Russian-Ukraine crisis shows that Turkey, China, Egypt, and India are the countries that are most dependent on food supplies from Russia and Ukraine. These are incidentally also major textile and apparel suppliers globally. Inflation in Turkey has skyrocketed to almost 54.44 per cent in February 2022, which is expected to significantly impact sourcing from the country. Consumer prices inflation in Bangladesh has also risen rapidly to 6.17 per cent, predominantly due to increase in food prices.

On the other hand, textiles and clothing demand is expected to be impacted heavily as prices of textile-apparel and leather products are also expected to rise sharply. The UNCTAD note suggests a 10 per cent rise in consumer prices for textiles, apparel, and leather products due to a rise in container freight rates. The analysis is restricted only to impact from freight rates which hasn't happened yet. However, the actual impact may perhaps be higher when raw material and labour costs are factored into the consumer prices.